![Featured image for “Understanding Home Warranties: A Guide for Homeowners and Buyers [Sponsored]”](https://lakeanna.online/wp-content/uploads/2024/07/chandler-scaled-e1722519076895.jpeg)

Imagine this: you’ve just settled into your new home, and everything seems perfect. But then, the unthinkable happens—your air conditioning unit fails in the middle of a sweltering summer or your dishwasher suddenly stops working. The repair bills start piling up, and you find yourself wishing you had a safety net to cushion the blow. This is where a home warranty steps in.

A home warranty is more than just a service contract; it’s a financial safety net designed to protect homeowners from the unexpected repair costs of major systems and appliances. Unlike homeowners insurance, which covers damage from events like fires or natural disasters, a home warranty focuses on the wear and tear that occurs over time. It’s like having a backup plan for life’s little (and not-so-little) mishaps, offering a layer of security when things go awry.

Especially for first-time home buyers, it can be overwhelming to make such an important purchase, so it is important to have peace of mind for at least the first year that there will not be any devastating out-of-pocket costs.

What Does a Home Warranty Cover?

Home warranties typically cover a broad range of systems and appliances, including: electrical, plumbing, heating and cooling systems, kitchen appliances, and washers and dryers. However, coverage can vary significantly between different warranty providers. That’s why it’s crucial to read the contract carefully to understand what is included and what isn’t. Some companies offer customizable plans that allow you to add or remove coverage based on your specific needs. This flexibility can be especially useful for tailoring the warranty to fit older homes with aging systems or newer homes with modern appliances.

A home warranty can offer substantial peace of mind by providing a safety net for unexpected breakdowns. For homebuyers, it can also be an attractive feature that adds value to a property. When planning to put your home on the market, a home warranty can serve as a strong selling point.

However, it’s important to weigh the cost of the warranty against the potential savings from covered repairs. In some cases, the annual premium and service fees might exceed the cost of repairs out-of-pocket. Therefore, doing thorough research, consulting reviews, and seeking recommendations are essential steps to make an informed decision about whether a home warranty is right for you.

To secure a home warranty for an existing home, contact a home warranty provider and select a plan that suits your needs. Most companies offer a variety of plans that cover different combinations of systems and appliances.

For more information contact Stacie or Madison Chandler at www.staciesellslka.com or call (540) 219-1882.

Hi! I’m Jennifer Bailey and I partner with entrepreneurs who have massive ideas that could change the world. Most marketing is meaningless. Filled with empty promises, its only job is to bring in new traffic, new leads, and new customers. But I’ve drawn a line in the sand, and I’ve learned that marketing can do so much more than reach business goals and build profit. My methods give businesses the fire and soul they need to reach the right people, set the groundwork for sustainable relationships, and offer true value to the people on both the giving and receiving ends of marketing.

Subscribe for Updates

Sponsors

latest articles

Coastal Chic Permanent Jewelry to Make Debut at Lake Anna Home Tour [Sponsored]

![Featured image for “Coastal Chic Permanent Jewelry to Make Debut at Lake Anna Home Tour [Sponsored]”](https://lakeanna.online/wp-content/uploads/2026/02/CC4.jpg)

Congratulations to Lake Anna Idol Winners [Photo Gallery]

![Featured image for “Congratulations to Lake Anna Idol Winners [Photo Gallery]”](https://lakeanna.online/wp-content/uploads/2026/02/1-scaled.png)

Fish Fry Fridays in Mineral through March

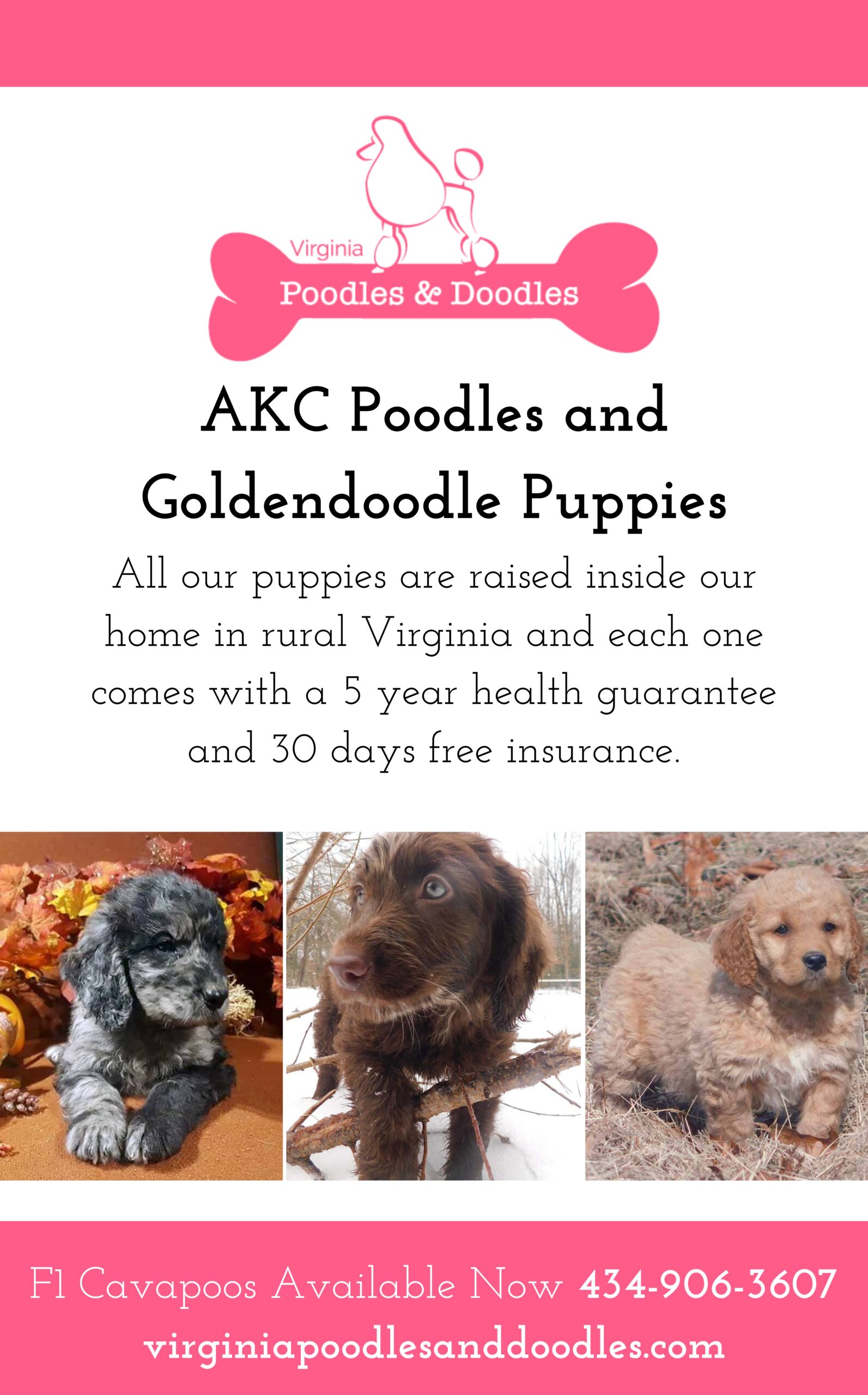

From One Poodle to a Full Pack: Inside Louisa County Poodles & Doodles [Sponsored]

![Featured image for “From One Poodle to a Full Pack: Inside Louisa County Poodles & Doodles [Sponsored]”](https://lakeanna.online/wp-content/uploads/2026/02/1-scaled.jpg)

Mineral Express Purchased by Owner of Elk Creek Store

$900M Kalahari Resort Set to Open in Spotsylvania County this Fall

Imagine this: you’ve just settled into your new home, and everything seems perfect. But then, the unthinkable happens—your air conditioning unit fails in the middle of a sweltering summer or your dishwasher suddenly stops working. The repair bills start piling up, and you find yourself wishing you had a safety net to cushion the blow. This is where a home warranty steps in.

A home warranty is more than just a service contract; it’s a financial safety net designed to protect homeowners from the unexpected repair costs of major systems and appliances. Unlike homeowners insurance, which covers damage from events like fires or natural disasters, a home warranty focuses on the wear and tear that occurs over time. It’s like having a backup plan for life’s little (and not-so-little) mishaps, offering a layer of security when things go awry.

Especially for first-time home buyers, it can be overwhelming to make such an important purchase, so it is important to have peace of mind for at least the first year that there will not be any devastating out-of-pocket costs.

What Does a Home Warranty Cover?

Home warranties typically cover a broad range of systems and appliances, including: electrical, plumbing, heating and cooling systems, kitchen appliances, and washers and dryers. However, coverage can vary significantly between different warranty providers. That’s why it’s crucial to read the contract carefully to understand what is included and what isn’t. Some companies offer customizable plans that allow you to add or remove coverage based on your specific needs. This flexibility can be especially useful for tailoring the warranty to fit older homes with aging systems or newer homes with modern appliances.

A home warranty can offer substantial peace of mind by providing a safety net for unexpected breakdowns. For homebuyers, it can also be an attractive feature that adds value to a property. When planning to put your home on the market, a home warranty can serve as a strong selling point.

However, it’s important to weigh the cost of the warranty against the potential savings from covered repairs. In some cases, the annual premium and service fees might exceed the cost of repairs out-of-pocket. Therefore, doing thorough research, consulting reviews, and seeking recommendations are essential steps to make an informed decision about whether a home warranty is right for you.

To secure a home warranty for an existing home, contact a home warranty provider and select a plan that suits your needs. Most companies offer a variety of plans that cover different combinations of systems and appliances.

For more information contact Stacie or Madison Chandler at www.staciesellslka.com or call (540) 219-1882.

Hi! I’m Jennifer Bailey and I partner with entrepreneurs who have massive ideas that could change the world. Most marketing is meaningless. Filled with empty promises, its only job is to bring in new traffic, new leads, and new customers. But I’ve drawn a line in the sand, and I’ve learned that marketing can do so much more than reach business goals and build profit. My methods give businesses the fire and soul they need to reach the right people, set the groundwork for sustainable relationships, and offer true value to the people on both the giving and receiving ends of marketing.

Subscribe for Updates

Sponsors

latest articles

Coastal Chic Permanent Jewelry to Make Debut at Lake Anna Home Tour [Sponsored]

![Featured image for “Coastal Chic Permanent Jewelry to Make Debut at Lake Anna Home Tour [Sponsored]”](https://lakeanna.online/wp-content/uploads/2026/02/CC4.jpg)

Congratulations to Lake Anna Idol Winners [Photo Gallery]

![Featured image for “Congratulations to Lake Anna Idol Winners [Photo Gallery]”](https://lakeanna.online/wp-content/uploads/2026/02/1-scaled.png)

Fish Fry Fridays in Mineral through March

From One Poodle to a Full Pack: Inside Louisa County Poodles & Doodles [Sponsored]

![Featured image for “From One Poodle to a Full Pack: Inside Louisa County Poodles & Doodles [Sponsored]”](https://lakeanna.online/wp-content/uploads/2026/02/1-scaled.jpg)

Mineral Express Purchased by Owner of Elk Creek Store

$900M Kalahari Resort Set to Open in Spotsylvania County this Fall

Spotsylvania Tourism Growth Outpaces Statewide Averages with 35% Surge Since 2019

Article By Jen Bailey

![Featured image for “[Spotsylvania] New Speed Enforcement in School Zones”](https://lakeanna.online/wp-content/uploads/2025/09/Blog-pic-scaled.jpg)

[Spotsylvania] New Speed Enforcement in School Zones

Article By Jen Bailey