![Featured image for “New Years’ Financial Resolutions: Making them Stick [Sponsored]”](https://lakeanna.online/wp-content/uploads/2025/12/LAMG-Social-Media-Template-Set-Landscape-1-scaled.png)

Written by Edward Jones, Sponsored by Scott Jordan

As the calendar flips to a new year, millions of Americans pledge to improve their financial lives. But without a concrete plan, those well-intentioned resolutions often fade quickly.

Financial goals consistently top the list of New Year’s resolutions. A 2025 CFP Board study shows that financial resolutions are prominent, with saving more money (45%) and reducing debt (32%) ranking among the top three goals.

Unfortunately, most resolutions don’t last. A 2023 Forbes Health poll found that over half of people give up on resolutions by the four-month mark and only 1% make it the full year.

The challenge isn’t a lack of desire for change. People may set the same resolution year after year, revealing a disconnect between intentions and action. Or it may be that they try to tackle too many goals at once, or aim higher than is realistic, setting themselves up for disappointment.

Set smart financial goals. Before crafting your action plan, consider which financial priorities matter most to you. If you need ideas, here are some areas where you may want focus in 2026: 1) Regularly review your financial goals and track progress toward meeting them; Increase your 401(k) contributions or max out your IRA and/or HSA contributions; 2) Pay down debt strategically and negotiate lower interest payments; 3) Build an emergency savings fund of six to 12 months; and 4) Save more consistently

Be specific. Vague resolutions like “save more money” rarely succeed. Instead, it can help to make goals specific and measurable. For example, rather than making a resolution to “start an emergency fund,” commit to a specific goal, such as, “I will put $100 a month into an emergency fund.”

This shift from general to specific transforms wishful thinking into actionable steps. When goals are attainable, it’s easier to track progress and stay motivated.

Find an accountability partner. Don’t go it alone. Having someone to check in with can help you stay on track. This could be a spouse, friend or family member who shares similar goals.

Consider working with a financial advisor who can help you create a realistic plan, monitor your progress and adjust strategies as needed. A professional can provide expertise and accountability, making it easier to stay on track throughout the year.

Start small and build momentum. Rather than overhauling your entire financial life all at once, focus on one or two priority areas. Identify where the largest gap exists between your current situation and where you want to be, then concentrate your energy there.

Breaking larger goals into smaller, manageable actions makes them less overwhelming and more achievable. Each small win builds confidence and momentum for tackling the next challenge. The new year offers a fresh start and renewed motivation to improve your financial health. With specific goals, a solid action plan and the right support system, this could be the year your financial resolutions finally stick.

Photo: Heather Hursh, Senior Office Administrator, and Scott Jordan, Financial Advisor, Call (540) 967-0372.

Hi! I’m Jennifer Bailey and I partner with entrepreneurs who have massive ideas that could change the world. Most marketing is meaningless. Filled with empty promises, its only job is to bring in new traffic, new leads, and new customers. But I’ve drawn a line in the sand, and I’ve learned that marketing can do so much more than reach business goals and build profit. My methods give businesses the fire and soul they need to reach the right people, set the groundwork for sustainable relationships, and offer true value to the people on both the giving and receiving ends of marketing.

Subscribe for Updates

Sponsors

latest articles

Amazon Brings Holiday Magic to Families on the Santa Express

Letter from the Editor: My Christmas Story

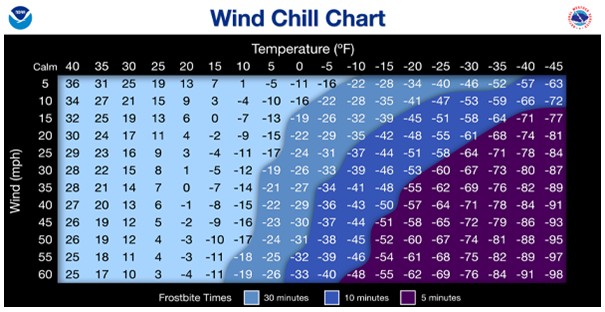

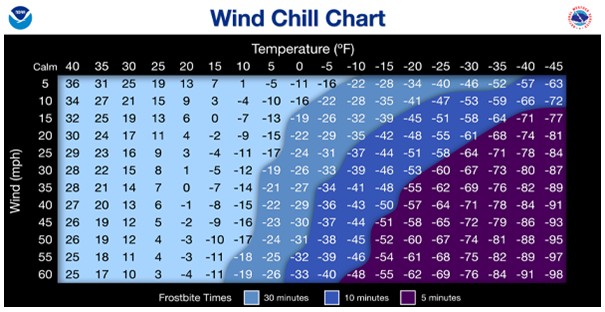

Wind Chill and Cold Safety

Monthly Gatherings Power the Lake Anna Business Partnership

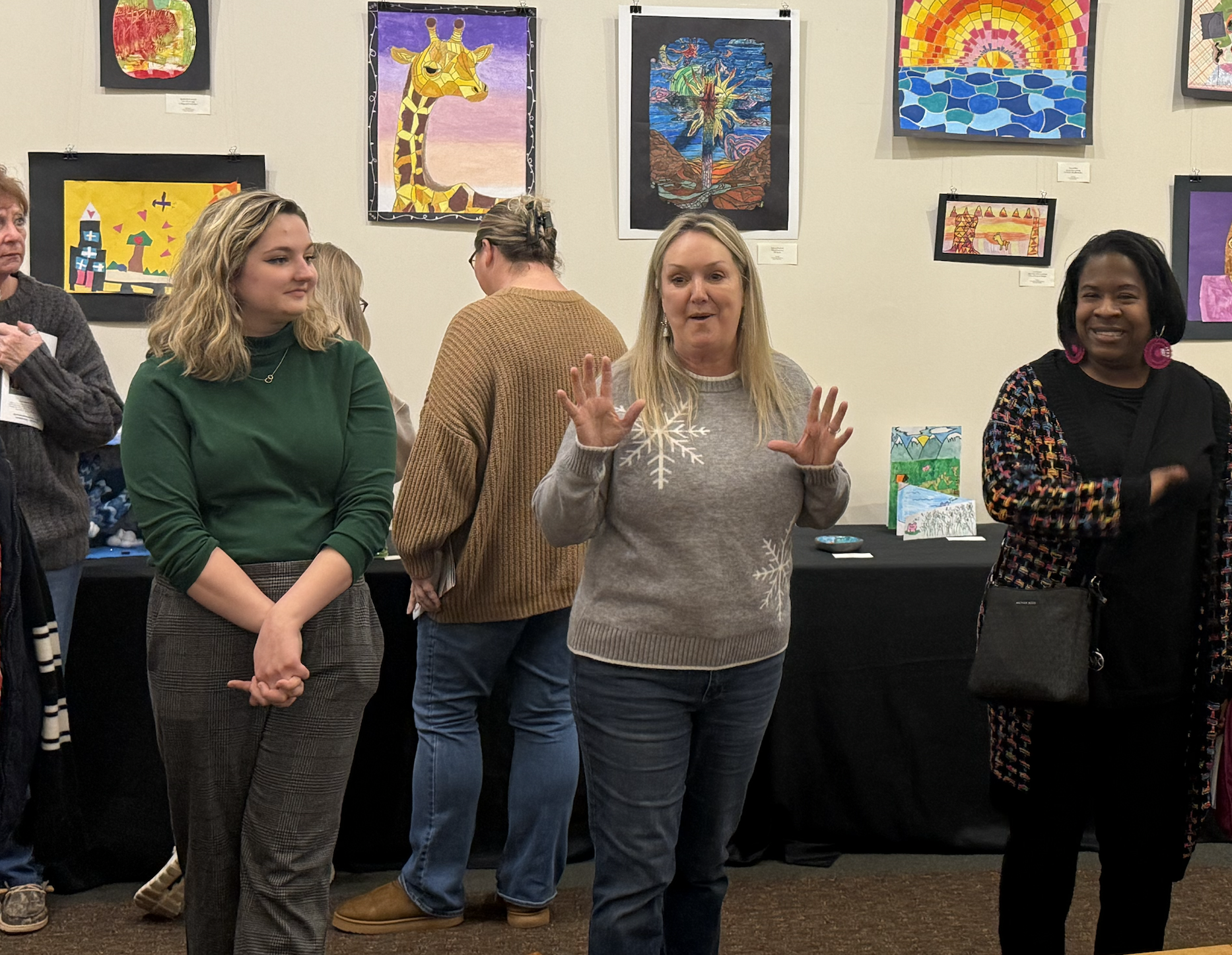

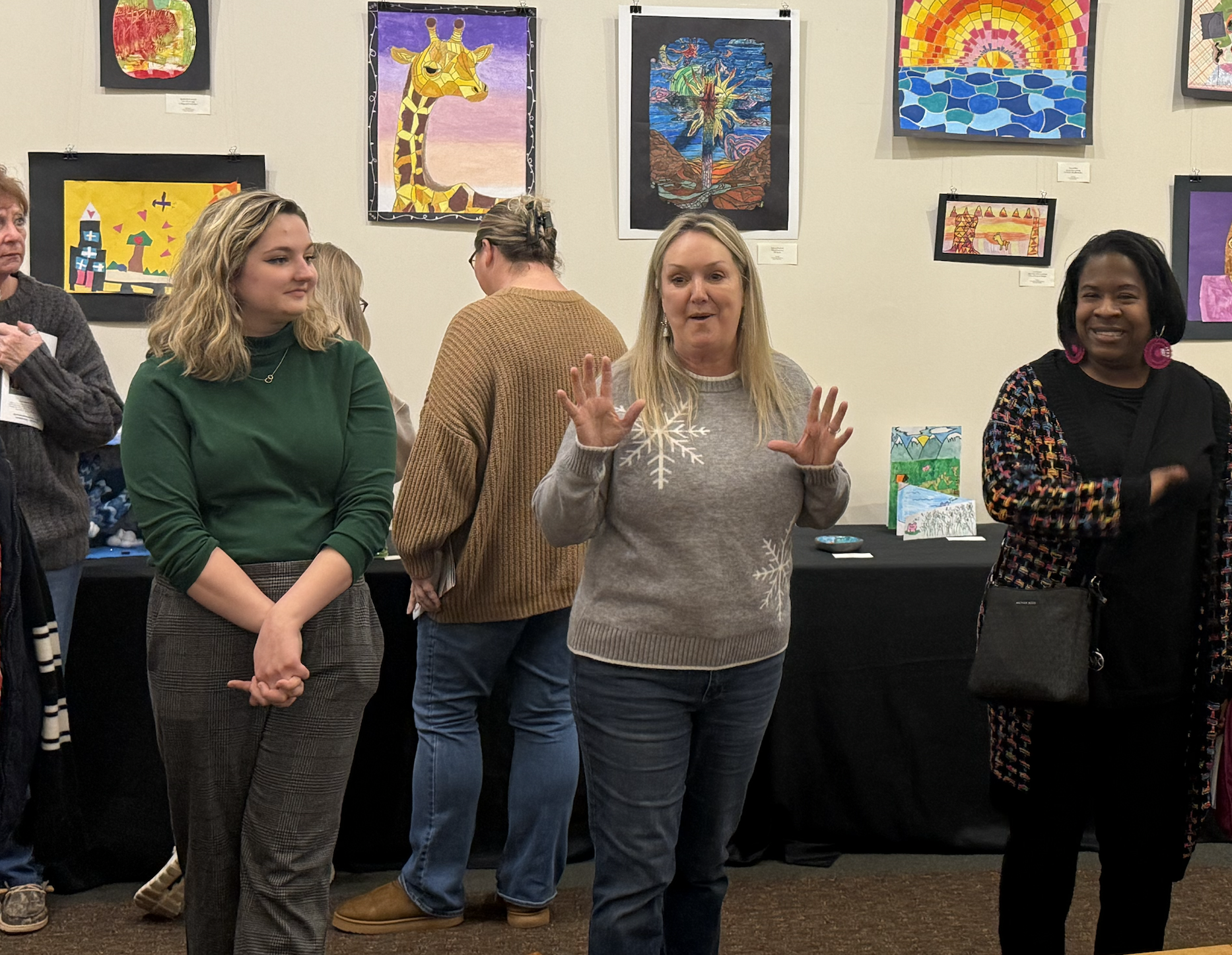

Student Artists Take Center Stage at Louisa Arts Center

Beaus Perspective: They’re Out There

Written by Edward Jones, Sponsored by Scott Jordan

As the calendar flips to a new year, millions of Americans pledge to improve their financial lives. But without a concrete plan, those well-intentioned resolutions often fade quickly.

Financial goals consistently top the list of New Year’s resolutions. A 2025 CFP Board study shows that financial resolutions are prominent, with saving more money (45%) and reducing debt (32%) ranking among the top three goals.

Unfortunately, most resolutions don’t last. A 2023 Forbes Health poll found that over half of people give up on resolutions by the four-month mark and only 1% make it the full year.

The challenge isn’t a lack of desire for change. People may set the same resolution year after year, revealing a disconnect between intentions and action. Or it may be that they try to tackle too many goals at once, or aim higher than is realistic, setting themselves up for disappointment.

Set smart financial goals. Before crafting your action plan, consider which financial priorities matter most to you. If you need ideas, here are some areas where you may want focus in 2026: 1) Regularly review your financial goals and track progress toward meeting them; Increase your 401(k) contributions or max out your IRA and/or HSA contributions; 2) Pay down debt strategically and negotiate lower interest payments; 3) Build an emergency savings fund of six to 12 months; and 4) Save more consistently

Be specific. Vague resolutions like “save more money” rarely succeed. Instead, it can help to make goals specific and measurable. For example, rather than making a resolution to “start an emergency fund,” commit to a specific goal, such as, “I will put $100 a month into an emergency fund.”

This shift from general to specific transforms wishful thinking into actionable steps. When goals are attainable, it’s easier to track progress and stay motivated.

Find an accountability partner. Don’t go it alone. Having someone to check in with can help you stay on track. This could be a spouse, friend or family member who shares similar goals.

Consider working with a financial advisor who can help you create a realistic plan, monitor your progress and adjust strategies as needed. A professional can provide expertise and accountability, making it easier to stay on track throughout the year.

Start small and build momentum. Rather than overhauling your entire financial life all at once, focus on one or two priority areas. Identify where the largest gap exists between your current situation and where you want to be, then concentrate your energy there.

Breaking larger goals into smaller, manageable actions makes them less overwhelming and more achievable. Each small win builds confidence and momentum for tackling the next challenge. The new year offers a fresh start and renewed motivation to improve your financial health. With specific goals, a solid action plan and the right support system, this could be the year your financial resolutions finally stick.

Photo: Heather Hursh, Senior Office Administrator, and Scott Jordan, Financial Advisor, Call (540) 967-0372.

Hi! I’m Jennifer Bailey and I partner with entrepreneurs who have massive ideas that could change the world. Most marketing is meaningless. Filled with empty promises, its only job is to bring in new traffic, new leads, and new customers. But I’ve drawn a line in the sand, and I’ve learned that marketing can do so much more than reach business goals and build profit. My methods give businesses the fire and soul they need to reach the right people, set the groundwork for sustainable relationships, and offer true value to the people on both the giving and receiving ends of marketing.

Subscribe for Updates

Sponsors

latest articles

Amazon Brings Holiday Magic to Families on the Santa Express

Letter from the Editor: My Christmas Story

Wind Chill and Cold Safety

Monthly Gatherings Power the Lake Anna Business Partnership

Student Artists Take Center Stage at Louisa Arts Center

Beaus Perspective: They’re Out There

Spotsylvania Tourism Growth Outpaces Statewide Averages with 35% Surge Since 2019

Article By Jen Bailey

![Featured image for “[Spotsylvania] New Speed Enforcement in School Zones”](https://lakeanna.online/wp-content/uploads/2025/09/Blog-pic-scaled.jpg)

[Spotsylvania] New Speed Enforcement in School Zones

Article By Jen Bailey