Sponsored and Written by Brian McGovern

The 2025 mortgage market is showing signs of improvement, bringing opportunities for homebuyers, homeowners, and investors alike.

While challenges around rates and affordability persist, there’s plenty of reason for optimism as trends point toward a more favorable landscape.

The good news is that mortgage rates are expected to decline gradually this year. While we won’t see a return to the record lows of a few years ago, experts predict the average 30-year fixed mortgage rate will fall between 5.75% and 6.5% by year’s end. This slight drop could provide much-needed relief for buyers and homeowners looking to refinance.

For buyers, lower rates mean a chance to secure financing at more affordable monthly payments. However, if you find a home that fits your needs and budget, don’t wait too long hoping for rates to drop further—competition in key markets remains strong. For homeowners who bought during the recent rate peaks, refinancing could lower your payments or help consolidate debt.

While home prices are expected to rise by about 3.5% this year, it’s a slower pace than the 5.8% increase seen in 2024.

For buyers, this means slightly less pressure on affordability, though inventory in high-demand areas may remain tight. If you’re planning to sell, expect steady demand, especially in regions experiencing population growth.

Key Mortgage Trends

Creative Loan Products

With affordability still a concern, products like adjustable-rate mortgages (ARMs), temporary buy down options, and down payment assistance programs are gaining traction. These solutions can help buyers navigate higher upfront costs while keeping monthly payments manageable.

Refinancing to Reduce Costs

Declining rates bring opportunities to refinance, especially for homeowners managing high credit card debt. Refinancing can allow you to consolidate high-interest debt into a lower-interest mortgage, potentially saving hundreds of dollars each month. If you’re struggling with debt, consider creating a strict budget or exploring a home equity loan or line of credit (HELOC) to pay off balances more efficiently.

Tech-Driven Processes

The mortgage process is becoming more seamless thanks to digital closings, automated underwriting, and AI tools. These advancements save time and also provide personalized guidance, especially for those navigating complex financial situations, like high debt-to-income ratios.

If you’re considering buying, refinancing, or even just weighing your options, preparation is key. Get pre-approved, understand your budget, and focus on long-term goals rather than trying to perfectly time the market.

Whether you’re looking to save on debt, secure a dream home, or make your next big investment, partnering with a knowledgeable mortgage professional can help you navigate 2025’s opportunities with confidence.

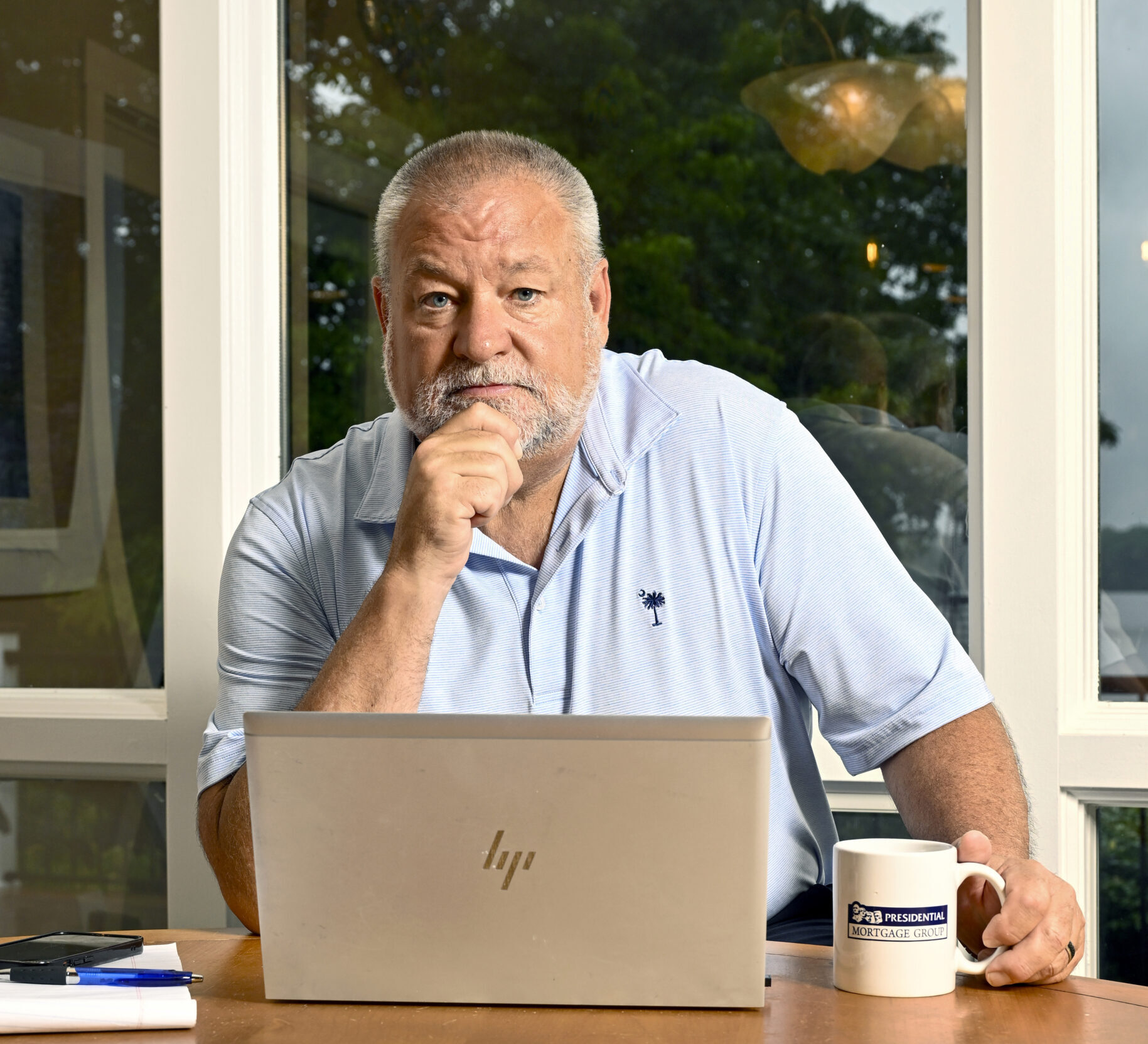

Brian McGovern

SENIOR LOAN OFFICER, PRESIDENTIAL MORTGAGE

30+ years of experience

✓ Purchasing ✓ Construction Loans

✓ Refinancing ✓ Lot Loans

[email protected]

Phone: (703) 929-5581

Hi! I’m Jennifer Bailey and I partner with entrepreneurs who have massive ideas that could change the world. Most marketing is meaningless. Filled with empty promises, its only job is to bring in new traffic, new leads, and new customers. But I’ve drawn a line in the sand, and I’ve learned that marketing can do so much more than reach business goals and build profit. My methods give businesses the fire and soul they need to reach the right people, set the groundwork for sustainable relationships, and offer true value to the people on both the giving and receiving ends of marketing.

Subscribe for Updates

Sponsors

latest articles

Winter Storm Fern Causes Limited Impacts but Arctic Air Lingers

36 New Classrooms Added to Louisa Middle

PUBLIC HYDRILLA REVIEW OPEN THROUGH JAN. 21

Lake Anna Year in Review: Top 11 Most-Read Stories of 2025

Amazon Brings Holiday Magic to Families on the Santa Express

Letter from the Editor: My Christmas Story

Sponsored and Written by Brian McGovern

The 2025 mortgage market is showing signs of improvement, bringing opportunities for homebuyers, homeowners, and investors alike.

While challenges around rates and affordability persist, there’s plenty of reason for optimism as trends point toward a more favorable landscape.

The good news is that mortgage rates are expected to decline gradually this year. While we won’t see a return to the record lows of a few years ago, experts predict the average 30-year fixed mortgage rate will fall between 5.75% and 6.5% by year’s end. This slight drop could provide much-needed relief for buyers and homeowners looking to refinance.

For buyers, lower rates mean a chance to secure financing at more affordable monthly payments. However, if you find a home that fits your needs and budget, don’t wait too long hoping for rates to drop further—competition in key markets remains strong. For homeowners who bought during the recent rate peaks, refinancing could lower your payments or help consolidate debt.

While home prices are expected to rise by about 3.5% this year, it’s a slower pace than the 5.8% increase seen in 2024.

For buyers, this means slightly less pressure on affordability, though inventory in high-demand areas may remain tight. If you’re planning to sell, expect steady demand, especially in regions experiencing population growth.

Key Mortgage Trends

Creative Loan Products

With affordability still a concern, products like adjustable-rate mortgages (ARMs), temporary buy down options, and down payment assistance programs are gaining traction. These solutions can help buyers navigate higher upfront costs while keeping monthly payments manageable.

Refinancing to Reduce Costs

Declining rates bring opportunities to refinance, especially for homeowners managing high credit card debt. Refinancing can allow you to consolidate high-interest debt into a lower-interest mortgage, potentially saving hundreds of dollars each month. If you’re struggling with debt, consider creating a strict budget or exploring a home equity loan or line of credit (HELOC) to pay off balances more efficiently.

Tech-Driven Processes

The mortgage process is becoming more seamless thanks to digital closings, automated underwriting, and AI tools. These advancements save time and also provide personalized guidance, especially for those navigating complex financial situations, like high debt-to-income ratios.

If you’re considering buying, refinancing, or even just weighing your options, preparation is key. Get pre-approved, understand your budget, and focus on long-term goals rather than trying to perfectly time the market.

Whether you’re looking to save on debt, secure a dream home, or make your next big investment, partnering with a knowledgeable mortgage professional can help you navigate 2025’s opportunities with confidence.

Brian McGovern

SENIOR LOAN OFFICER, PRESIDENTIAL MORTGAGE

30+ years of experience

✓ Purchasing ✓ Construction Loans

✓ Refinancing ✓ Lot Loans

[email protected]

Phone: (703) 929-5581

Hi! I’m Jennifer Bailey and I partner with entrepreneurs who have massive ideas that could change the world. Most marketing is meaningless. Filled with empty promises, its only job is to bring in new traffic, new leads, and new customers. But I’ve drawn a line in the sand, and I’ve learned that marketing can do so much more than reach business goals and build profit. My methods give businesses the fire and soul they need to reach the right people, set the groundwork for sustainable relationships, and offer true value to the people on both the giving and receiving ends of marketing.

Subscribe for Updates

Sponsors

latest articles

Winter Storm Fern Causes Limited Impacts but Arctic Air Lingers

36 New Classrooms Added to Louisa Middle

PUBLIC HYDRILLA REVIEW OPEN THROUGH JAN. 21

Lake Anna Year in Review: Top 11 Most-Read Stories of 2025

Amazon Brings Holiday Magic to Families on the Santa Express

Letter from the Editor: My Christmas Story

Spotsylvania Tourism Growth Outpaces Statewide Averages with 35% Surge Since 2019

Article By Jen Bailey

![Featured image for “[Spotsylvania] New Speed Enforcement in School Zones”](https://lakeanna.online/wp-content/uploads/2025/09/Blog-pic-scaled.jpg)

[Spotsylvania] New Speed Enforcement in School Zones

Article By Jen Bailey